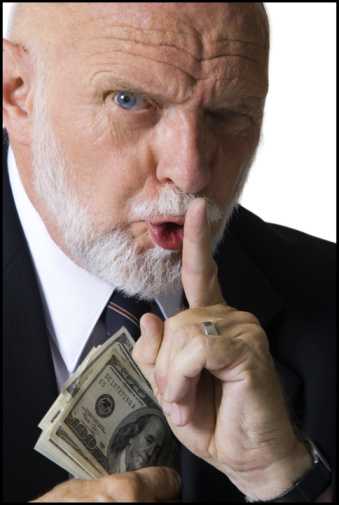

The U.S. Chamber of Commerce estimates that 75% of all employees steal at least once, and that half of these steal again …and again. The Chamber also reports that one of every three business failures are the direct result of employee theft. Loss Prevention executives responding to the University of Florida National Retail Security Survey attribute 42.7% of their annual shrinkage losses to employee theft. So how can a company prevent this type of unwanted activity? Each industry is different but here are some good overall pointers.

The U.S. Chamber of Commerce estimates that 75% of all employees steal at least once, and that half of these steal again …and again. The Chamber also reports that one of every three business failures are the direct result of employee theft. Loss Prevention executives responding to the University of Florida National Retail Security Survey attribute 42.7% of their annual shrinkage losses to employee theft. So how can a company prevent this type of unwanted activity? Each industry is different but here are some good overall pointers.

- Pre-screen employees. For as little as $20 you can check criminal records, credit history or other information. Employers can identify theft patterns, workplace violence issues or previous sexual harassment problems and react accordingly. Addressing these issues before employment begins is much easier than attempting to correct a problem uncovered after the start of employment.

- Conduct frequent physical inventories. Pilferage is one of the most common forms of internal loss. Reconcile sales to inventory on a quarterly basis, or at least annually, with the help of a third party. Conduct surprise inventories.

- Separate bookkeeping functions. Misapplication of payments can lead to embezzlement. Do not let the same person who processes checks also manage the accounts receivable records.

- Personally approve bookkeeping adjustments. Approve any adjustments to the books no matter how slight – even adjustments to correct an error.

- Control check signers. Limit the number of signatories to yourself and one or two highly trusted assistants. Keep blank checks under lock and key.

- Review monthly bank statements. Instruct your bank to send the monthly statement directly to you. Review the statement before passing it on to your bookkeeper. This review allows you to spot any improperly executed checks.

- Tighten up on petty cash. Allow only one or two trusted employees to disburse petty cash. Require that a receipt and a signed voucher be submitted for all petty cash disbursements.

- Separate buying and bookkeeping. To maintain a system of checks and balances, assign ordering and payment responsibilities to different employees.

- Watch company credit cards. Require all credit cards be signed out and all credit card expenses be authorized by a purchase order.

- Document all expense reports. Require strict documentation for all reimbursable expenses incurred by employees. Subject every expense account voucher to a pre-audit review procedure before payment.

- Have a third party refund policy. Issue refunds only upon the approval of a third party, preferably a trusted assistant.By taking a look at these policies and procedures and making adjustments, companies can avoid a myriad of problems and therefore increase productivity and profitability.

Following these pointers will go a long way in preventing employee theft.